Wealth Inequality: A Snapshot of Who Owns What

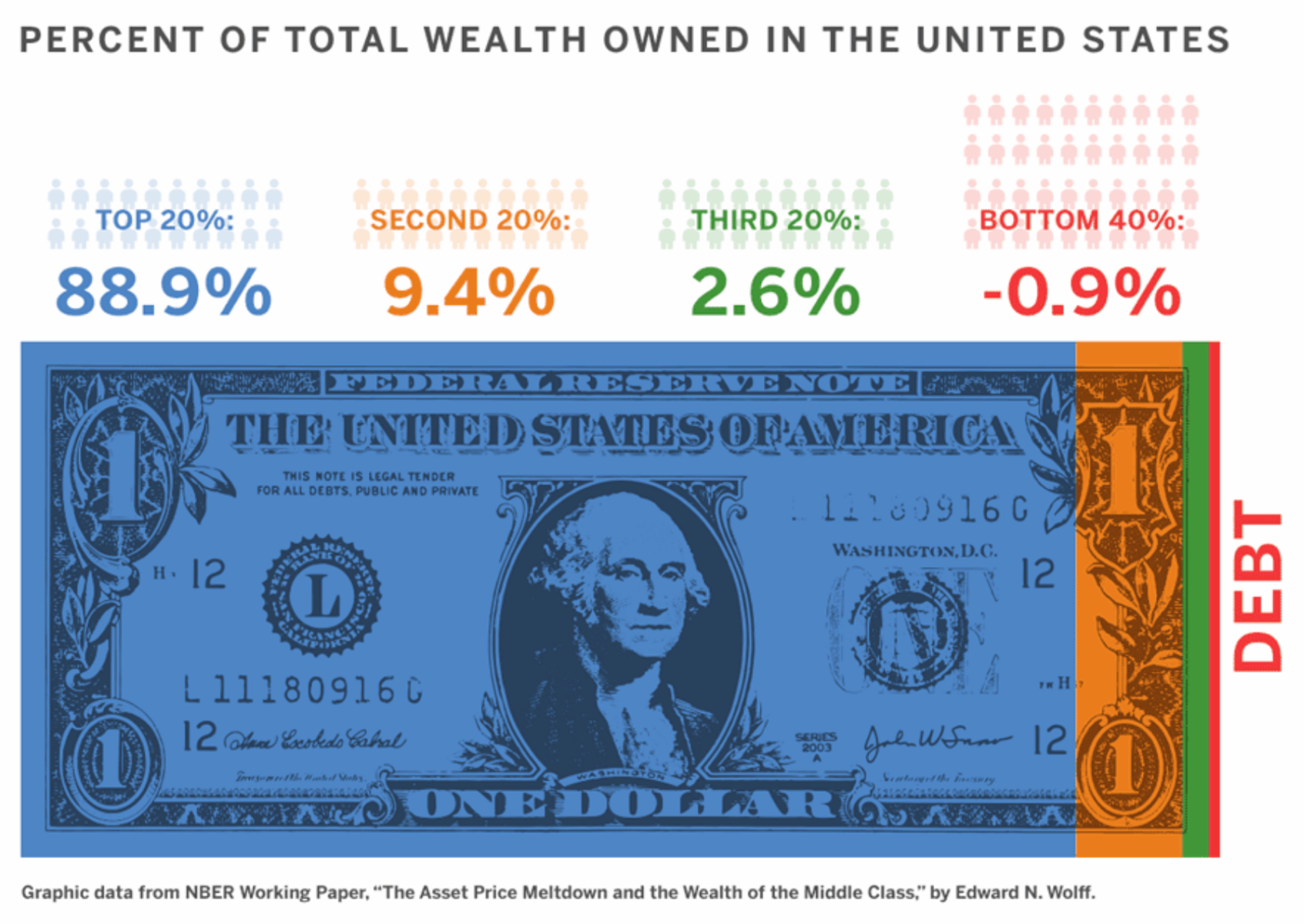

Have you ever wondered how striking wealth inequality in America truly is? Well, according to data from economist Edward Wolff, the top 20% of the population owns nearly 90% of all wealth. The bottom 40% owns approximately -1% of all wealth, meaning the bottom 40% actually owes money and is in debt, instead of having any wealth. Does anyone else see the problem with so many households being in debt bondage?

Have you ever wondered how striking wealth inequality in America truly is? Well, according to data from economist Edward Wolff, the top 20% of the population owns nearly 90% of all wealth. The bottom 40% owns approximately -1% of all wealth, meaning the bottom 40% actually owes money and is in debt, instead of having any wealth. Does anyone else see the problem with so many households being in debt bondage?

One of the reasons this debt burden is so dangerous is due to the already fragile state of the economy. After the economic crisis of 2007 - 2008, most of the jobs added during the recovery were low-wage occupations. As a result, more families slipped further into poverty because of their overwhelming circumstances. This trend is likely to continue.

SEEK THE ANSWERS TO YOUR PROBLEMS

Although it is true that the cards are stacked against the average person and there are people out to get your money, the reality is that EVERYONE IS PLAYING THE GAME OF MONEY – WHETHER THEY KNOW IT OR NOT. This means it is your responsibility to learn the game and play to win. A wise person once said, “Don’t waste valuable time seeking someone to blame. Seek the answers to your problems instead.”

A SHIFT IN MINDSET IS NEEDED

For most people struggling to make ends meet, a shift in mindset is needed. Society conditions us to believe that wealth equates to the amount of material possessions we have. True wealth equals your time and freedom. It is the amount of time you can survive without having to work.

ONE OF THE FIRST THINGS YOU CAN DO

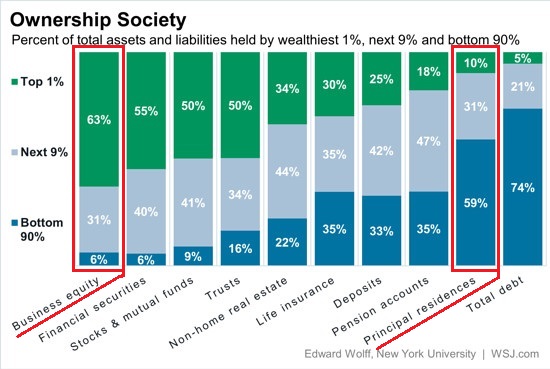

As shown in the chart below, the top 10% of the population – shown as the Top 1% and Next 9% – owns the majority of assets, or things that put money in your pocket. The chart shows the ownership of business equity, financial securities, stocks and mutual funds, trusts, and non-home real estate, etc. The richest in the nation understand the importance of owning assets. (Refer back to the image above.) The poorest, on the other hand, value the appearance of being wealthy, but don’t actually put in the work necessary to become wealthy. This is partially why the bottom 90% holds almost 75% of the debt.

To begin your path to financial freedom, one of the first things you can do is reduce your monthly expenses. Identify where you can cut costs in your spending. It may be eating out or impulse shopping, for example. Reducing your spending allows you to either use the money saved to reduce your debt or to purchase assets that put more money in your pocket, which is the key to wealth building. The important thing is to gain control of the money that leaves your wallet unnecessarily on a monthly basis. Once that hole is plugged, you can begin to accumulate assets, like the rich.