The College Gamble: Is It Still Worth It? (You Decide)

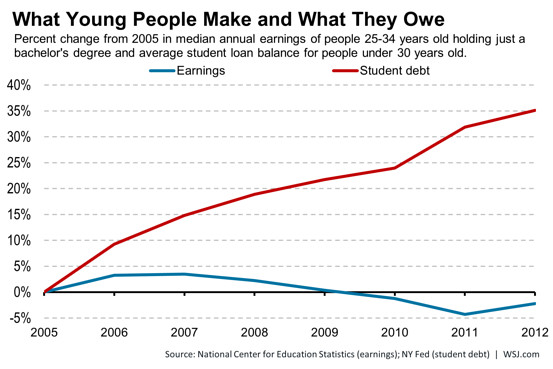

Students today don’t have the luxury of a strong job market like I did years ago. In fact, data show that recent high school graduates have it pretty bad. What makes the problem even worse is that in many cases, students are totally clueless of the weak economic conditions they are graduating into and the anemic outlook for job growth.

Many parents and educators are blindly encouraging students to attend college because it used to be the guaranteed path to a better quality of life and upward mobility. Putting it another way, since most people lack a financial education, it’s very difficult to see a situation at a different angle when you’ve been conditioned to see it from another. The combination of blind faith in college and lack of financial education will wreak havoc on numerous unwitting students who will be saddled with student loan debt. Sadly, statistics and data show that, in the end, many students should have foregone college altogether and sculpted another path to financial freedom.

The following are some points to consider when determining if college is worth the gamble:

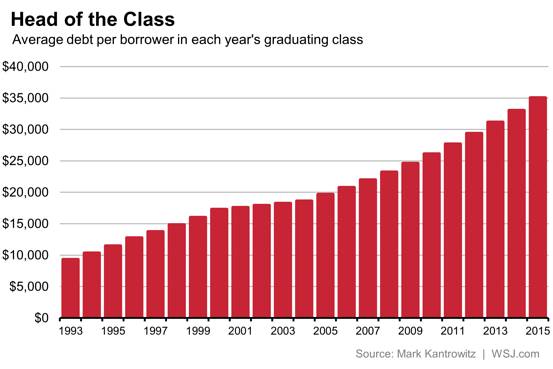

Average Student Debt is Increasing

According to an analysis of government data by Mark Kantrowitz of Edvisors, the average class of 2015 college graduate with student loan debt will have to pay back a little more than $35,000. This figure makes the class of 2015 the most indebted ever.

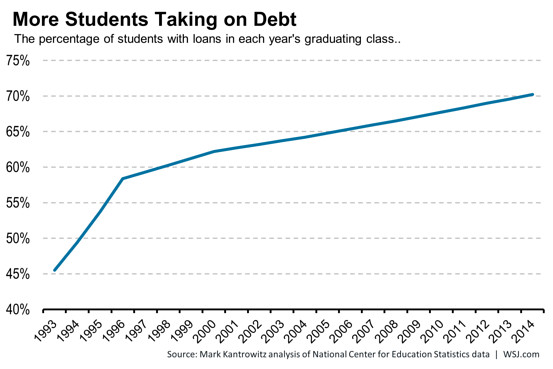

More Students Require Loans

As tuition rates increase, more students are taking out loans to fund their college educations. Nearly 71% of bachelor’s degree recipients will graduate with a student loan. Two decades ago, the figure was less than half, and it was around 64% 10 years ago.

Employed College Graduates in Lower-Level Jobs

According to a report by the Economic Policy Institute, “In 2007, 38 percent of employed college graduates under age 27 were working in a job that did not require a college degree, and this share increased to 46 percent by 2014 (Abel and Deitz 2014).” The report goes on to state, “These trends underscore that the unemployment crisis since 2007 among young workers more broadly did not arise because young people today lack enough education or skills. Rather, it stems from weak demand for goods and services, which makes it unnecessary for employers to significantly ramp up hiring.”

Any young adult considering college should really evaluate the situation. The objective of a college education is to be able to use the knowledge in order to earn a living. Data show that this is becoming increasingly more difficult as quality jobs grow scarcer.

It may be time to weigh the benefits of going it the financial education route.

References:

1. http://www.epi.org/publication/the-class-of-2015/

2. http://blogs.wsj.com/economics/2015/05/08/congratulations-class-of-2015-youre-the-most-indebted-ever-for-now/